Welcome to Fix My Books

Bookkeeping | Expertise Bookkeeping | Tax Preparation & Filing | Accounting System Setup Services

Grow your business.

Let us handle the bookkeeping.

How much can I save by outsourcing my bookkeeping?

Bookkeeping?

Tax Preparation & Filing?

Our Awards & Accolades

-

![]()

2025 Bookkeeping Excellence Awards - Professional Leader of the Year

Certified Professional Bookkeepers of Canada

-

![]()

2025 Top 50 International ProAdvisor

Insightful Accountant

-

![]()

2024 Rising Star in Tax Resolution

American Society of Tax Problem Solvers

-

![]()

2024 Forbes 30 Under 30 Semi-Finalist for Finance

Forbes North America

-

![]()

2023 Bookkeeping Excellence Awards - New Firm of the Year - Winner

Certified Professional Bookkeepers of Canada

-

![]()

2023 Equity Entrepreneur Award - Winner

Greater Niagara Chamber of Commerce - Women in Busines Awads

-

![]()

2023 Emerging Business Award - Finalist

Greater Niagara Chamber of Commerce - Women in Business Awards

-

![]()

2023 Women's Business Club Awards - Women in Finance - Runner Up

Women’s Business Club Awards

-

![]()

2023 Startup of the Year - Business Services - Gold

The Stevie Awards

-

![]()

2023 Best Young Female Entrepreneur - Silver

The Stevie Awards

-

![]()

2023 Best Female Entrepreneur in Canada - Bronze

The Stevie Awards

-

![]()

2023 Female Entrepreneur of the Year (Young) - Gold

Globee Awards Women in Business

-

![]()

2023 Female Achiever - Rising Star of the Year - Silver

Globee Awards Women in Business

-

![]()

2023 Female Entrepreneur of the Year - Accounting - Silver

Globee Awards Women in Business

-

![]()

2023 Women-owned Startup of the Year - Bronze

Globee Awards Women in Business

-

![]()

2023 Entrepreneur of the Year - New Startup - Platinum

Titan Awards Women in Business

-

![]()

2023 Entrepreneur of the Year - Future Leader of the Year - Gold

Titan Awards Women in Business

Bookkeeping Services

Monthly Bookkeeping

Whether your business is new or mature, small or large, single-owner operated or diverse, our boutique monthly bookkeeping services are customized to cater to all types.

Catch up & Clean up Bookkeeping

When life gets in the way, things can fall through the cracks. Whether you haven’t done your bookkeeping for a couple of months, or a few years, we can catch up and clean up your books.

Expertise Bookkeeping Services

Jane Payments App Medical Bookkeeping

If you’re a healthcare professional you are probably using Jane Payments App. If you aren’t sure how to accurately record the sales and payouts, you’ve come to the right place.

Legal Billing and Trust Accounting (IOLTA) Bookkeeping

Legal professionals and immigration consultants know how important trust account accuracy is for their clients. However, sometimes it can be difficult to get the trust account in balance.

Personal Real Estate Corporation (PREC) Bookkeeping

Whether you have just moved from a Sole Proprietorship to a PREC, or you have been running a PREC for a while but are inundated with admin work, we can help.

Amazon Bookkeeping

If you are new to Amazon Seller Central and Kindle Direct Publishing, or if you’re established and need some help figuring out your sales taxes, we are here to help.

Etsy Bookkeeping

Whether you are working with leather or wood, selling knickknacks or boutique customized products, bookkeeping and taxes may not be your cup of tea. Bookkeeping for Etsy is our specialty.

Shopify Bookkeeping

Selling to Canada, the United States, or globally via Shopify, you are probably stuck on sales taxes and struggling to reconcile various types of payment processors. Large or small, we’ve done it all.

Tax Preparation & Filing

Individual + Joint T1 Filing

If you’re new to taxes, stuck on a particular schedule, or tired of trying to work it out yourself, we get it. Your time is more valuable, so leave the paperwork headaches to us.

New Immigrant T1 Filing

Just landed in Canada and not sure if you have to file a return, or even how to file one? Even if you have no income it is best to file as 3 years of tax returns can be used for your citizenship application.

Rental Income T1 + T776 Filing

Do you own a rental property but are not quite certain on how to properly complete a T776, what can be claimed, and what is off-side? Sit back, relax, you’ve come to the right place.

Sole Proprietor T1 + T2125 Filing

Have you just started a small business? Or perhaps have been running your own operation for several years? We’ve seen it all, from contractors to copywriters, and dog-walkers to designers.

Partnership T1 + T2125 Filing

If you’ve just started a new partnership, or have an existing one with less than $2 million in revenue, and $5 million in assets, Fix My Books is here to help file your return.

Corporate T2 Filing + Bookkeeping

If you’ve started a corporation in Canada you have a lot to keep on top of. From annual filings and minute books, to payroll and dividends, as well as the bookkeeping and tax filing in between. Let us help!

Accounting System Setup Services

Quickbooks Online + Payroll Setup Services

If you are a new business needing to setup your accounting system, or expanding and requiring payroll, or even migrating from Quickbooks Desktop to Quickbooks Online, Fix My Books can help.

Amazon A2X Setup & Quickbooks Online Integration

If you are a new or existing Amazon seller and are stuck on trying to figure out how to integrate Amazon, A2X and Quickbooks Online, you’ve come to the right place. This is our specialty.

Etsy A2X Setup & Quickbooks Online Integration

Selling on Etsy but finding sales taxes to be a little overwhelming? That’s why we recommend integrating Etsy with A2X and Quickbooks to make sure your sales taxes are done right.

Shopify A2X Setup & Quickbooks Online Integration

We know that Shopify owner’s love their apps! We see dozens in each Shopify store, but sometimes there are a few which you need a little extra help with. We can help you integrate Shopify with Quickbooks and A2X.

People Love to Work with Us!

⭐ ⭐ ⭐ ⭐ ⭐

-

![]()

“Incredible service! Arielle & Jason took something that made me really uncomfortable when it came to my business and completely changed the game for me so I could focus on the stuff I know how to do! I love that they utilize some great tools like ClientHub to make the process easy and effortless. Very happy that I found them to help with my business books! I was worried that I would feel dumb when it came to how I was running things but they made me feel instantly comfortable over Zoom! If you need to catch up on bookkeeping definitely reach out to Fix My Books.”

– Jonah, E-Commerce Beauty & Cosmetics

⭐ ⭐ ⭐ ⭐ ⭐

-

![]()

“I've been working with Arielle and Jason for over a year for my bookkeeping and my taxes, and they're absolutely the best. It's so nice having two incredible people working on my business finances behind the scenes as they never leave me anything to worry about! I also love the use of ClientHub because it makes communication and getting things done so easy. The speed and efficiency with which they do things always blows me away. So happy to be working with Fix My Books!”

– Sarah, Business Software Consultant

⭐ ⭐ ⭐ ⭐ ⭐

-

![]()

“We have been working with Arielle and the Fix My Books team for the past 2 years, and to say they are amazing would be an understatement. Their professionalism , ample knowledge, willingness to go above and beyond to make us feel comfortable, and the drive to set our business up for success has been immeasurable. I couldn't recommend Arielle and the Fix My Books team enough!”

– Nilab, Digital Advertising & Marketing

⭐ ⭐ ⭐ ⭐ ⭐

-

![]()

“I have been working with Arielle at Fix My Books Inc. for over 6 months. We went through a full reconciliation of my books that were slightly out of date and she pulled everything together like a master. I have had my books reconciled every month since and it's been such a massive weight off of my shoulders knowing that I can count on her to keep my business financial picture accurate and up-to-date. I highly recommend Fix My Books Inc.!! Thank you Arielle for being so consistent and reliable!”

– Paul, Photographer

⭐ ⭐ ⭐ ⭐ ⭐

-

![]()

“I found Fix my Books during a challenging time in my personal and professional life when I had a backlog of personal and business tax filings with an unknown liability ahead of me. Jason worked with me over months, giving sound advice and deep expertise until we were fully caught up. Jason, thank you for shepherding me through this. I had the good fortune to witness and benefit from your technical know-how and your character through the process. You have my gratitude, trust and admiration. You have my business, no doubt. I wholeheartedly recommend you, and Fix my Books to anyone in the market for solid business partnership and advice.”

– Ayesha, Public Speaker, Business Coach & Author

⭐ ⭐ ⭐ ⭐ ⭐

-

![]()

“Fix My Books are the first bookkeepers that have actually understood my e-commerce business! They asked questions, did research, and built a custom plan to get my books in order and streamline my accounting & reporting. They're super friendly, easy to work with, and an indispensable resource for any small business owner.”

– Kimberly, E-Commerce Horror Clothing & Apparel

⭐ ⭐ ⭐ ⭐ ⭐

-

![]()

“Hands down the best bookkeepers I've ever worked with. Incredibly knowledgeable, hard-working, reliable, and they're always available to answer any question I have. Fix My Books was a lifesaver for me and my small business.”

– Jonathan, E-Commerce Clothing & Apparel

⭐ ⭐ ⭐ ⭐ ⭐

-

![]()

“I recently had the pleasure of working with Jason for my personal taxes, and cannot recommend him and Fix My Books highly enough. From start to finish, the experience was exceptional – Jason truly went above and beyond to ensure everything was completed quickly and with great attention to detail.”

– Morgan, Therapist

⭐ ⭐ ⭐ ⭐ ⭐

-

![]()

“Arielle took over our bookkeeping earlier this year, and we are thoroughly pleased with her services. She is consistently accessible, knowledgeable, efficient and professional. From the start, Arielle has been impressively timely; she has a very streamlined approach to tasks and makes communication easy. I would highly recommend Fix My Books!”

– Nicole, Licensed Master Electrician

⭐ ⭐ ⭐ ⭐ ⭐

-

![]()

“Arielle and her team demonstrated a deep knowledge of accounting and bookkeeping and have consistently provided expert advice and guidance on various financial matters. Their responsiveness and attention to detail are top-notch, and they are incredibly diligent about ensuring that my financial records are up to date. Overall, I can't recommend them highly enough. They are knowledgeable, trustworthy, and dedicated, and I feel fortunate to have them on my team!”

– Kawhi, E-Commerce Beauty & Cosmetics

⭐ ⭐ ⭐ ⭐ ⭐

Our Memberships & Certifications

What You Can Expect From Us

Timely Response

We reply to your messages, emails and phone calls within the 24-48 hours.

We take pride and distinguish ourselves from others with prompt responsiveness and professionalism.

You deserve trustworthy bookkeeping, tax preparation and business planning professionals who will answer your questions, phone calls, and emails.

We do not go M.I.A. when you need us most!

Year-Round Support

We are here to provide you with support.

There are always a lot of questions when it comes to the complicated world of finance and taxation. As a business owner, you are always on call, and so are we.

There’s no stopwatch on this relationship. If you have a question, or you need something, just ask!

We want you to grow your business because we succeed together.

Proactive Guidance

We provide proactive guidance to improve your bottom line and grow your business.

Every business owner wants to have a profitable journey, however your historical performance is the basis for your books, but it is not a predictor of future performance.

If we see a process that can increase revenue or improve operational efficiency and margins - we will help you.

Client Portal

All of our clients are granted access to our Client Portal at no charge.

Here you can securely send messages, files and tasks so that we can quickly and effectively manage your books and provide you support and guidance.

All Client Portal data is hosted via Google Cloud and Amazon Web Services via US-based data centers and 256-bit encryption.

We aim to be available to our clients securely and conveniently.

Document Management

We get rid of your receipt shoebox and replace it with Hubdoc - a digital file cabinet that makes storing and sorting receipts simple .

Don’t keep stuffing your receipts into a box in the corner where it can become lost, forgotten or illegible.

Those are your tax savings going to waste.

Every client receives a unique email address with Hubdoc where they can send their receipts to and we will do the rest. No more data entry, no more filing.

Data Security

We take your data and financial information seriously! Super seriously!

We maintain both on-site and off-site backups of your data so that it doesn’t get lost in the woodwork and your business is not left stranded.

Off-site backups use end-to-end encrypted solutions that meet ISO 27001, HIPAA, CCPA, GDPR and DPA compliance standards.

Even if you don’t choose us, ask your bookkeeper and accountant what they do to keep your data secure.

News & Updates

Fix My Books is proud to announce that Gabrielle (“Arielle”) Smith, CPB, Co-Founder of Fix My Books, has been awarded Professional Leader of the Year by Certified Professional Bookkeepers of Canada (CPB Canada).

The Professional Leader of the Year Award celebrates an outstanding CPB who exemplifies the highest standards and values of CPB Canada and has made a meaningful impact in the profession and for clients within the past year.

Fix My Books is pleased to announce that Gabrielle Smith has been named a 2025 Top 50 International ProAdvisor by Insightful Accountant, the leading news and information source written specifically for the small business advisor to keep up with current technology, trends in the industry and continuing their education.

In this video, Jason Smith from Fix My Books dives into the ultimate cost-of-living comparison between Ontario, Canada, and Florida, USA! 🔍 Using data from trusted sources like Zillow, Realtor, CA X, and Patisan.com, Jason breaks down the costs of renting a three-bedroom, two-bathroom home, utilities, sales tax, and more.

In this video, Jason Smith compares the cost of healthcare in Ontario, Canada, and Florida, USA, shedding light on the key differences between these two regions' healthcare systems. Using data from the 2024-2025 Ontario budget and details about U.S. healthcare plans, Jason walks you through Cost of Healthcare in Ontario vs. Florida.

In this detailed tax comparison video, Jason Smith breaks down the key differences between living in Ontario, Canada, and Florida, USA, specifically comparing Toronto and Miami. Using the $100,000 US dollar (or $140,000 CAD) income from last week's tax bracket discussion, Jason dives into five critical areas…

In this video, Jason Smith dives deep into a detailed comparison of tax brackets between Ontario, Canada, and Florida, USA, with a special focus on Toronto and Miami. Whether you're a Canadian looking to invest in a Florida vacation home or considering a move to the Sunshine State, this video will give you key insights into how tax systems differ across the two regions.

📋 Are you managing corporate records or preparing for a company dissolution? This video is your ultimate guide to legal compliance and efficient record-keeping for Canadian businesses!

Stay tuned for our upcoming video series, where we’ll provide in-depth coverage on each step involved in closing your Canadian Controlled Private Corporation (CCPC).

Are you planning to dissolve your Canadian-Controlled Private Corporation (CCPC)? In this video, we provide a detailed guide on the legal process, including preparing and filing Articles of Dissolution, notifying stakeholders, and canceling business licenses and permits.

Stay tuned for our upcoming video series, where we’ll provide in-depth coverage on each step involved in closing your Canadian Controlled Private Corporation (CCPC).

In this video, learn the step-by-step process for filing the final T2 Corporation Income Tax Return, obtaining a clearance certificate, and distributing remaining assets when dissolving a corporation in Canada. We’ll guide you through each requirement, from submitting Form TX19 to finalizing all tax obligations with the CRA.

Stay tuned for our upcoming video series, where we’ll provide in-depth coverage on each step involved in closing your Canadian Controlled Private Corporation (CCPC).

In this third part of our series on dissolving a Canadian-controlled private corporation (CCPC), we will help you navigate the final stages of dissolution, including paying off debts, notifying creditors, and distributing remaining assets. We break down the legal, financial, and tax obligations involved in closing your business, so you can ensure a smooth and compliant dissolution process.

Stay tuned for our upcoming video series, where we’ll provide in-depth coverage on each step involved in closing your Canadian Controlled Private Corporation (CCPC).

In this second part of our series on dissolving a Canadian-controlled private corporation (CCPC), we'll walk you through the key steps, from obtaining a resolution from the board of directors to securing shareholder approval. Learn what a resolution authorizing the dissolution is, what needs to be included in this document, and how to successfully obtain the necessary approvals.

Stay tuned for our upcoming video series, where we’ll provide in-depth coverage on each step involved in closing your Canadian Controlled Private Corporation (CCPC).

In this first part of our series on dissolving a Canadian-controlled private corporation (CCPC), we walk you through the essential steps of reviewing corporate documents to ensure compliance. Properly closing a business involves more than just filing paperwork – it requires a detailed review of the corporation's minute book, articles of incorporation, bylaws, and shareholder agreements.

Stay tuned for our upcoming video series, where we’ll provide in-depth coverage on each step involved in closing your Canadian Controlled Private Corporation (CCPC).

Are you looking to close your Canadian Controlled Private Corporation (CCPC) but unsure of the steps involved? In this comprehensive tutorial, we’ll guide you through the process of legally dissolving your CCPC, ensuring compliance with Canadian regulations.

Stay tuned for our upcoming video series, where we’ll provide in-depth coverage on each step involved in closing your Canadian Controlled Private Corporation (CCPC).

In this step-by-step tutorial, you’ll learn how to record a GST/HST instalment payment in QuickBooks Online specifically for Canadian businesses. Keeping your taxes organized is essential for accurate bookkeeping and tax filing, and this video will guide you through the simple process of entering your GST/HST payments properly.

Whether you’re a small business owner, bookkeeper, or accountant in Canada, this guide is perfect for ensuring your instalment payments are correctly recorded to avoid any mistakes with the CRA (Canada Revenue Agency).

Ever wondered what a day in the life of a remote bookkeeper looks like? In this video, I’ll walk you through my typical work-from-home routine as a remote bookkeeper and tax professional. From managing my to-do list with a Kanban board to handling payroll and filing tasks, you’ll get an inside look at how I stay productive, manage clients, and balance business operations all from my home office.

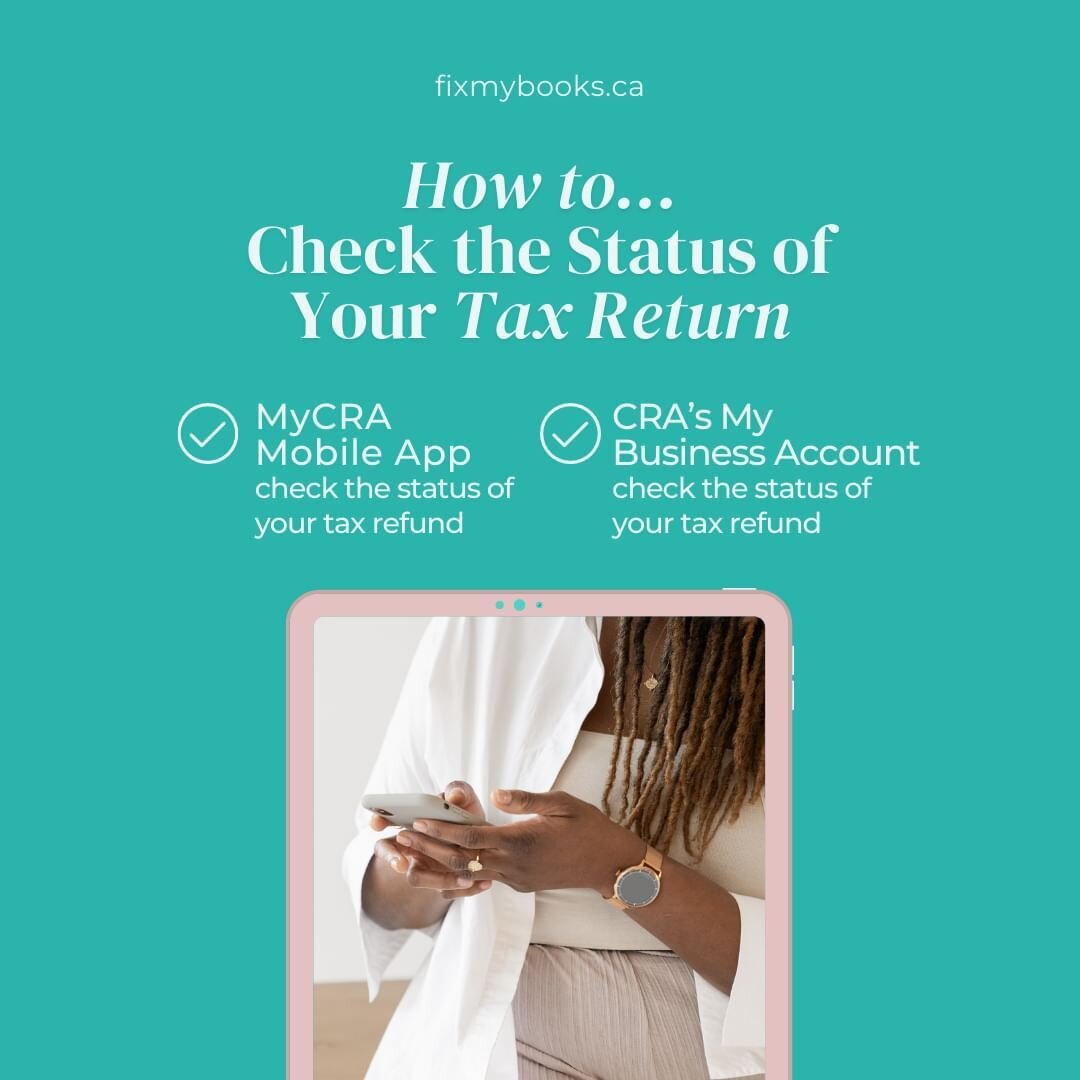

Welcome to our channel! In today’s video, we’re taking you on a comprehensive tour of the CRA My Business Account. Whether you're a new business owner or an experienced entrepreneur, managing your CRA business account efficiently is crucial for compliance and smooth operations. We’ll cover everything from account setup to daily maintenance, ensuring you get the most out of this essential tool. Stay tuned for an in-depth overview and practical tips on maintaining your CRA My Business Account.

Welcome to our channel! In today's video, we're exploring the critical reasons why bookkeeping is essential for every business. Whether you're a small business owner or managing a large corporation, bookkeeping plays a pivotal role in your financial health and success. From tracking financial performance to making informed decisions, we’ll highlight why you can’t afford to neglect this vital aspect of your business operations. Stay tuned to discover the importance of proper bookkeeping!

Welcome to our channel! In today's video, we're sharing practical tips and best practices for maintaining proper bookkeeping. Accurate and efficient bookkeeping is crucial for ensuring your business stays compliant and financially healthy. Whether you're a small business owner or managing a large enterprise, these strategies will help you keep your financial records in order. Stay tuned to learn how to streamline your bookkeeping processes and avoid common pitfalls.

Welcome to our channel! In today’s video, we’re uncovering the serious risks and negative consequences of neglecting bookkeeping. Proper bookkeeping is vital for maintaining financial health and ensuring business success. From financial mismanagement to potential business failure, we’ll explore the dangers of not having a solid bookkeeping system in place. Stay tuned to learn how you can protect your business from these pitfalls.

Welcome to our channel! In today’s video, we’re diving into the serious consequences of improper bookkeeping. Understanding the legal and financial penalties that can arise from poor bookkeeping practices is crucial for every business owner. We’ll highlight common mistakes and provide tips on how to avoid these costly errors. Stay tuned to protect your business from unnecessary risks.

Welcome to our channel! In today's video, we're uncovering the numerous benefits of bookkeeping for your business. Whether you're a small business owner or managing a large corporation, proper bookkeeping is essential. From maintaining accurate financial records to improving cash flow management, we'll explore how effective bookkeeping can enhance your business's success.

Welcome to our channel! In today's video, we're diving into the essentials of bookkeeping and accounting. If you've ever wondered about the differences between these two crucial financial processes, this video is for you. We’ll break down what bookkeeping entails and how it supports your overall accounting process. By the end, you'll have a clear understanding of why both are vital for your business's success.

Welcome to our channel! In today's video, we delve into the crucial role bookkeeping plays in your business's success. Whether you're a small business owner or running a large corporation, understanding bookkeeping is essential. We'll cover the basics, highlight the benefits, and explain the penalties and negative consequences of neglecting this vital aspect of your business. Stay tuned for practical tips on maintaining proper bookkeeping practices!

Welcome to our channel! In this video, Ashlin Hadden shares valuable insights on eCommerce insurance, specifically tailored for Amazon sellers. Learn about risk management, business protection, and essential tips for ensuring your small business is covered. Whether you're just starting out or looking to enhance your insurance strategy, this comprehensive guide has everything you need to know. Watch now to safeguard your Amazon FBA business and gain a competitive edge in the eCommerce industry.

Welcome to our channel! In this video, we dive into everything you need to know about Canada Revenue Agency (CRA) reviews, audits, and taxpayer rights. Whether you're a taxpayer or a professional navigating the CRA process, understanding these key points is crucial.

In this video I will be teaching you guys how to transfer your RRSP correctly and avoid what the CRA will consider an RRSP withdrawal!

Check out my socials for other tips and tricks on how to run a successful business in Canada, and as always, feel free to message me with any questions!

In this video, we delve into the key disparities between a CRA Notice of Collection and a Notice of Assessment, crucial aspects of taxpayer responsibilities. Understanding these government notices is essential in navigating tax disputes, safeguarding taxpayer rights, and ensuring legal compliance with financial obligations. Join us to learn how Revenue Canada issues these notices in the realm of Canadian taxes and how they impact tax preparation processes.

In this video, we delve into a comprehensive guide on understanding the CRA's Demand to File Notice.

We cover compliance tips, tax obligations, income reporting, and tax planning strategies to navigate through regulatory requirements effectively.

Check out my socials for other tips and tricks on how to run a successful business in Canada, and as always, feel free to message me with any questions!

We will be teaching you guys what a T4RSP is, what circumstances will lead to one being issued to you and absolute no-no's with regards to your RRSP!

Check out my socials for other tips and tricks on how to run a successful business in Canada, and as always, feel free to message me with any questions!

We will be teaching you guys how to get your Tax Returns filed for free! Check the video for details and eligibility!

Check out my socials for other tips and tricks on how to run a successful business in Canada, and as always, feel free to message me with any questions!

During tax season, threat actors ramp up their efforts to attempt to access taxpayers’ accounts at the Canada Revenue Agency (CRA) to file fraudulent tax returns and benefit claims.

To protect your personal information from increasing threats and unauthorized third parties, the CRA is continually introducing and improving its security measures.

In 2025, approximately 93% of income tax and benefit returns were filed online. If you typically file on paper, why not enjoy the benefits of online filing? It makes filing simpler and offers many benefits, such as receiving your refund quicker and not having to mail anything to the Canada Revenue Agency (CRA).

The Canada Revenue Agency (CRA) now sends most business correspondence online through the My Business Account portal in your CRA account, instead of by paper mail.

To make sure you receive notifications when new mail or important changes occur, add or update your email address in your CRA account.

The Canada Revenue Agency (CRA) is warning Canadians about certain financial arrangements involving critical illness insurance that may be designed to avoid paying taxes. These arrangements often involve complex transactions, like borrowing money and using it to pay for insurance, which can mislead taxpayers and result in serious tax consequences. The CRA has previously issued warnings about similar schemes including those involving Offshore Disability Insurance Plan and Offshore Leveraged Insured Annuity

November is Financial Literacy Month, and this year’s theme, ‘Talk Money,’ encourages Canadians to have open, honest conversations about their finances. Talking about money is not easy – we get it. However, improving your tax literacy can be directly beneficial to you! Learn how doing your taxes can put money in your pocket, help you save up for a home, or your retirement. We also share tips on how to protect your finances from scams and fraud.

Starting November 3, 2025, registrations for new business number (BN) or Canada Revenue Agency (CRA) program accounts must be done online. The CRA is moving away from phone-based registrations, so if you call the Business Enquiries (BE) line to register, you’ll be directed to the CRA’s secure online portal Business Registration Online (BRO).

This change is designed to make the registration process quicker, easier, and more secure for businesses. Here is what you need to know.

The Canada Revenue Agency (CRA) is committed to helping taxpayers correct their past tax mistakes. The Voluntary Disclosures Program (VDP) allows for well-intentioned taxpayers to voluntarily correct their tax affairs and receive some financial relief.

On October 1, 2025, changes to the VDP will come into effect. These changes will make it easier to correct unintentional filing errors or omissions and make the program more accessible.

Canadians have been contributing to tax-free savings accounts (TFSA) since 2009, enjoying tax-free investment growth. Did you know that it’s possible to overcontribute and be subject to tax?

A First Home Savings Account (FHSA) lets you save for a qualifying home with tax-free growth and tax-deductible contributions, making it a great option for potential first-time home buyers.

But, it’s important to make sure you don’t put too much into your FHSA. If you do, part of the tax-free growth you’re generating could end up going toward taxes anyway!

Here are some tips for how you can make the most of your FHSA and avoid any costly errors:

The Canada Revenue Agency (CRA) is enhancing and changing its authorization service for individuals. Here is what you need to know.

If you’re self-employed, tax season can feel overwhelming, but the Canada Revenue Agency (CRA) is here to help you! Whether you’re a sole proprietor, freelancer, or running a small business, understanding your tax obligations is key to staying on track. Here’s what you need to know:

The Canada Revenue Agency (CRA) is making it easier for newcomers arriving in Canada to apply for benefit and credit payments. Newcomers can now apply online, without mailing in the forms. It’s a quick and convenient way to apply.

Did you receive a letter from the Canada Revenue Agency (CRA) telling you that you owe money? We understand this can feel stressful, but we can work with you to resolve your debt.

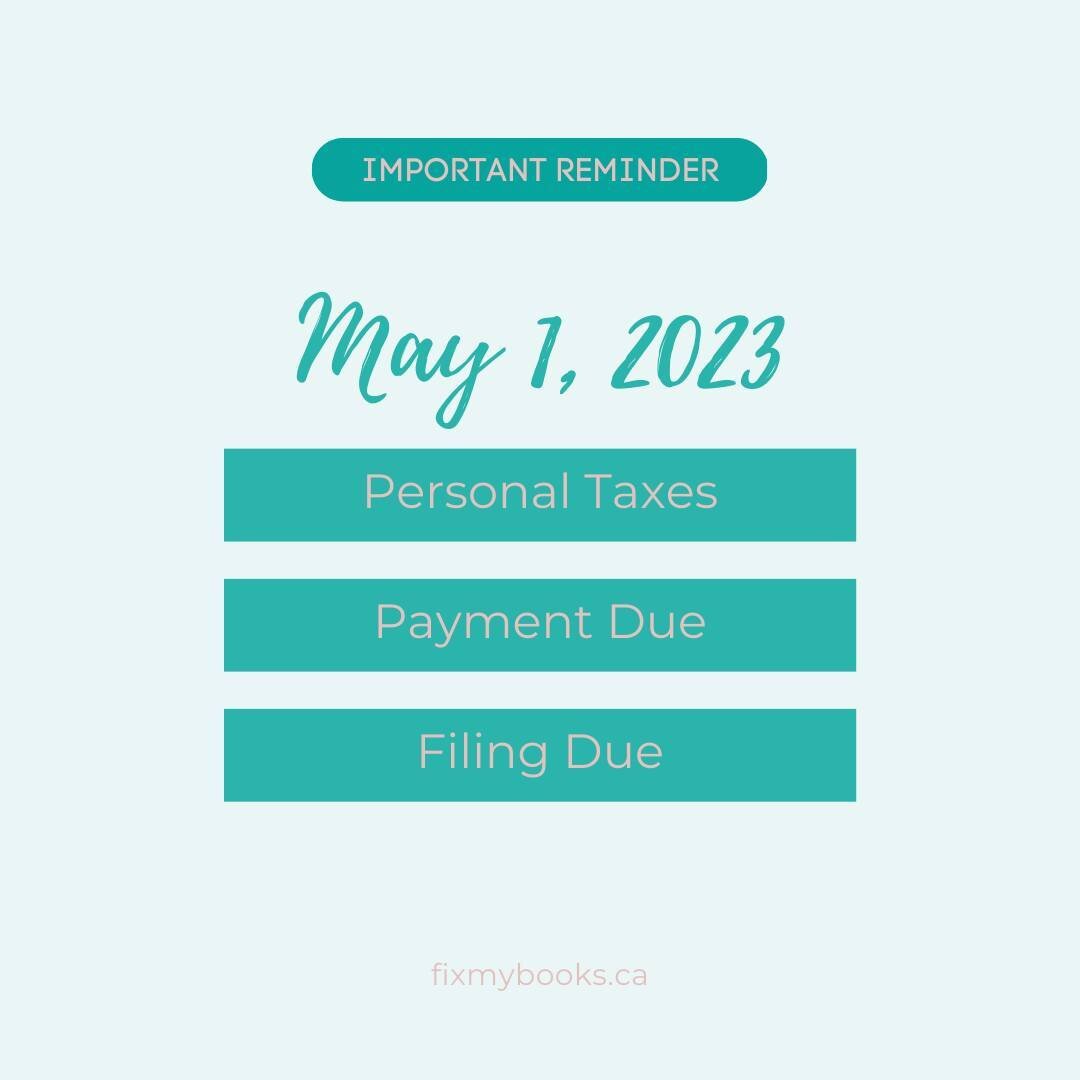

Understanding the tax filing and payment deadlines for Canadian businesses can be tricky since different businesses have different deadlines. When you factor in GST/HST responsibilities, it can be even more challenging. Use this tax tip as a quick reference for important due dates.

Submitting your change request online isn’t just faster, it’s also easy and secure. Some 2024 tax slips, such as the T3 (trust income), T4 (remuneration paid), T4A (pension and other income) and T5 (investment income), were not available in My Account or through the Auto-fill my Return service as early as in previous years. So, if you forgot to include something on your tax return or spotted a mistake after filing, don’t worry. Here’s how and why you should submit your change request online.

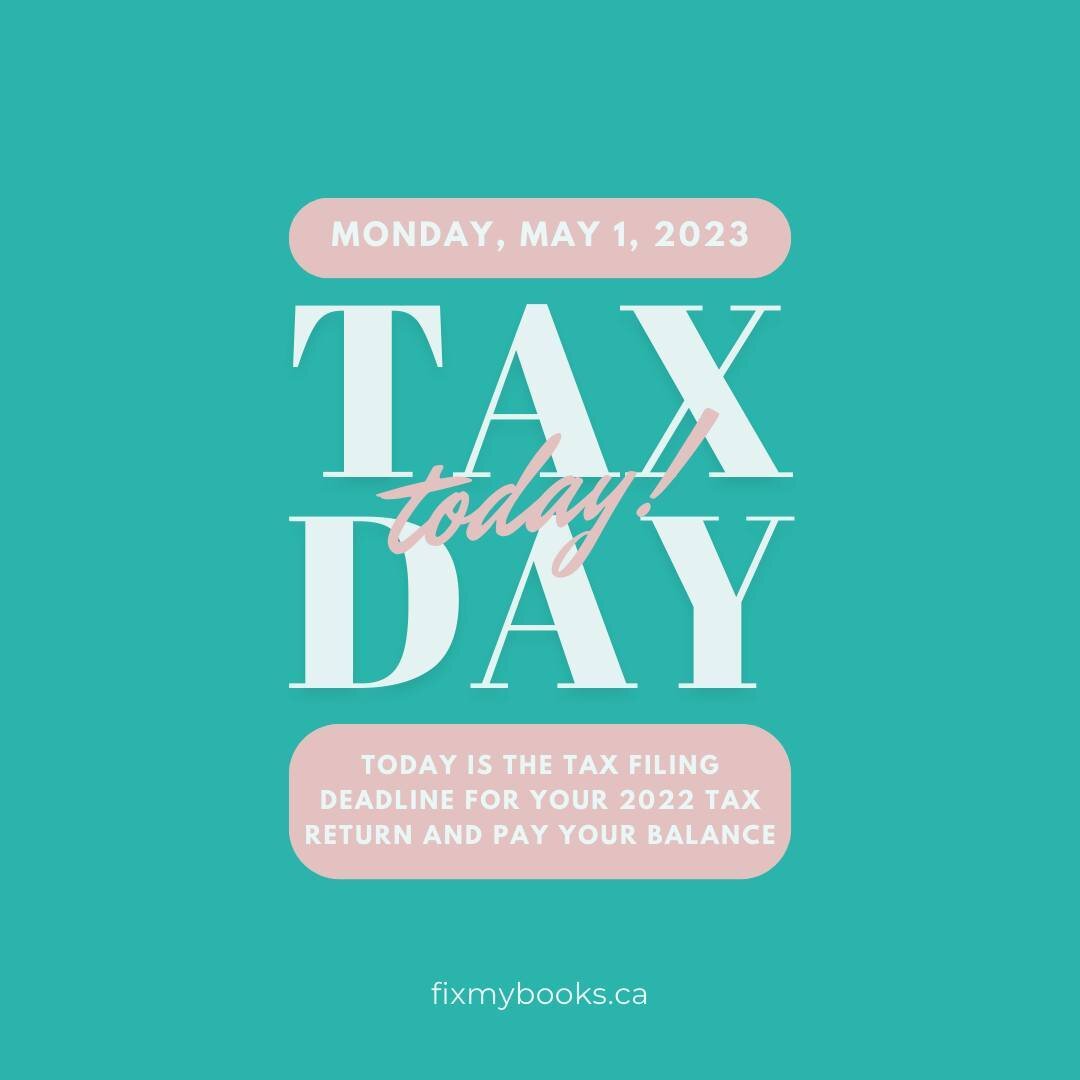

The Canada Revenue Agency (CRA) understands that life can move fast, and tasks like filing your income tax and benefit return can slip through the cracks. The deadline to file a 2024 tax return was April 30, 2025, but you can still file if you haven’t yet.

Starting May 12, 2025, the Canada Revenue Agency (CRA) will transition to online mail as the default method of delivering most business correspondence. This means you’ll start receiving most of your business notices and other correspondence through CRA’s secure online portal, My Business Account, instead of by mail.

Filing an income tax and benefit return might not be the highlight of your year, but it allows you to receive any benefit and credit payments you’re entitled to, and you may even get a refund. Although the clock is ticking, there's still time to file! By following the tips below, you can file your tax return with ease before the deadline.

The confidence and trust that individuals and businesses have in the CRA is a cornerstone of Canada’s tax system. The CRA regularly adjusts and improves its systems and processes to safeguard sensitive information against ever evolving threats to its digital services.

Doing your taxes each year can feel like a big job, but you don’t have to do it alone! If you have a modest income and a simple tax situation, you might be able to get help from a volunteer at a free tax clinic.

A modest income is less than $35,000 for a single person and less than $45,000 for a couple. Your tax situation is simple if, for example, you don’t have a small business or income from a rental property.

Volunteers can help with your taxes for this year, and it is possible to get them to help you do your taxes going back 10 years.

It’s never been easier to do your taxes online. In fact, online filing gets you access to the benefits, credits, and refunds you may be eligible for even faster! Last year, approximately 93% of Canadians filed their income tax and benefit returns online either themselves or through a tax preparer.

For the 2024 tax year, the Canada Revenue Agency (CRA) will continue to administer the enhanced trust reporting rules as enacted for tax years ending on or after December 31, 2023. Affected trusts are required to file a T3 Income Tax and Information Return (T3 return), including Schedule 15 (Beneficial Ownership Information of a Trust), unless specific conditions are met.

Before calling us, try the tips below to save time this tax season! You might be able to find the information you’re searching for and avoid time on the phone during our busiest season.

If you file information returns, such as the T3 (trust income), T4 (remuneration paid), T4A (pension and other income), or T5 (investment income), there are some important updates you need to be aware of.

Tax season starts next week! When the calendar flips to February 24, 2025, you will be able to file your income tax and benefit return online. With the right preparation, filing your tax return can be a smooth and stress-free experience.

The Canada Revenue Agency (CRA) is here to help you file with confidence. When you file, you could be eligible to receive a refund or benefit and credit payments that put money in your pocket.

Tax season is almost here! Whether you’re a seasoned filer or it’s your first time, having the essential information can save you time and stress. It could even put more money in your pocket.

To help you, we’ve put together the key facts of what you need to know for this tax-filing season. This includes what’s new with our digital services and on the income tax and benefit return.

If you lived in a northern or remote area for six months or more in 2024, you may qualify for the northern residents deductions. These deductions recognize the unique challenges northern residents face, such as higher living costs and limited access to services.

The deductions include a residency deduction and a travel deduction. These can provide relief for both your daily living expenses and eligible travel. If you are eligible, these deductions will reduce your taxable income.

Canada Revenue Agency (CRA) has reverted to administering the currently enacted capital gains inclusion rate of one-half. This means that all capital gains realized before January 1, 2026 will be subject to the currently enacted inclusion rate of one-half, unless an exemption applies.

The announcement also confirmed that the government intends to maintain the existing coming into force date of the proposed increase to the Lifetime Capital Gains Exemption (LCGE) limit to $1.25 million of eligible capital gains included in the previous Notice of Ways and Means Motion (NWMM) tabled in Parliament on September 23, 2024. This measure remains unchanged, and the CRA will continue to administer the proposed change, which applies to dispositions that occur on or after June 25, 2024. Indexation of the LCGE would resume in 2026.

You may be one of 2 million Canadians invited to use SimpleFile to automatically file your income tax and benefit return with the Canada Revenue Agency (CRA) for free this tax season!

The CRA is inviting individuals to use the SimpleFile by Phone service again this year. You may also be invited to try out a new digital option as part of a pilot, as we work to provide even more filing options to Canadians. With SimpleFile, you only need to answer a series of quick questions, and then the service uses your answers, with the information we have on file, to auto-file and process a tax return on your behalf.

Did you just move to Canada? Filing your income tax and benefit return is important to get the benefit and credit payments you’re entitled to. These payments can help support you financially.