REVISED - Tax obligations for commercial ridesharing and delivery services

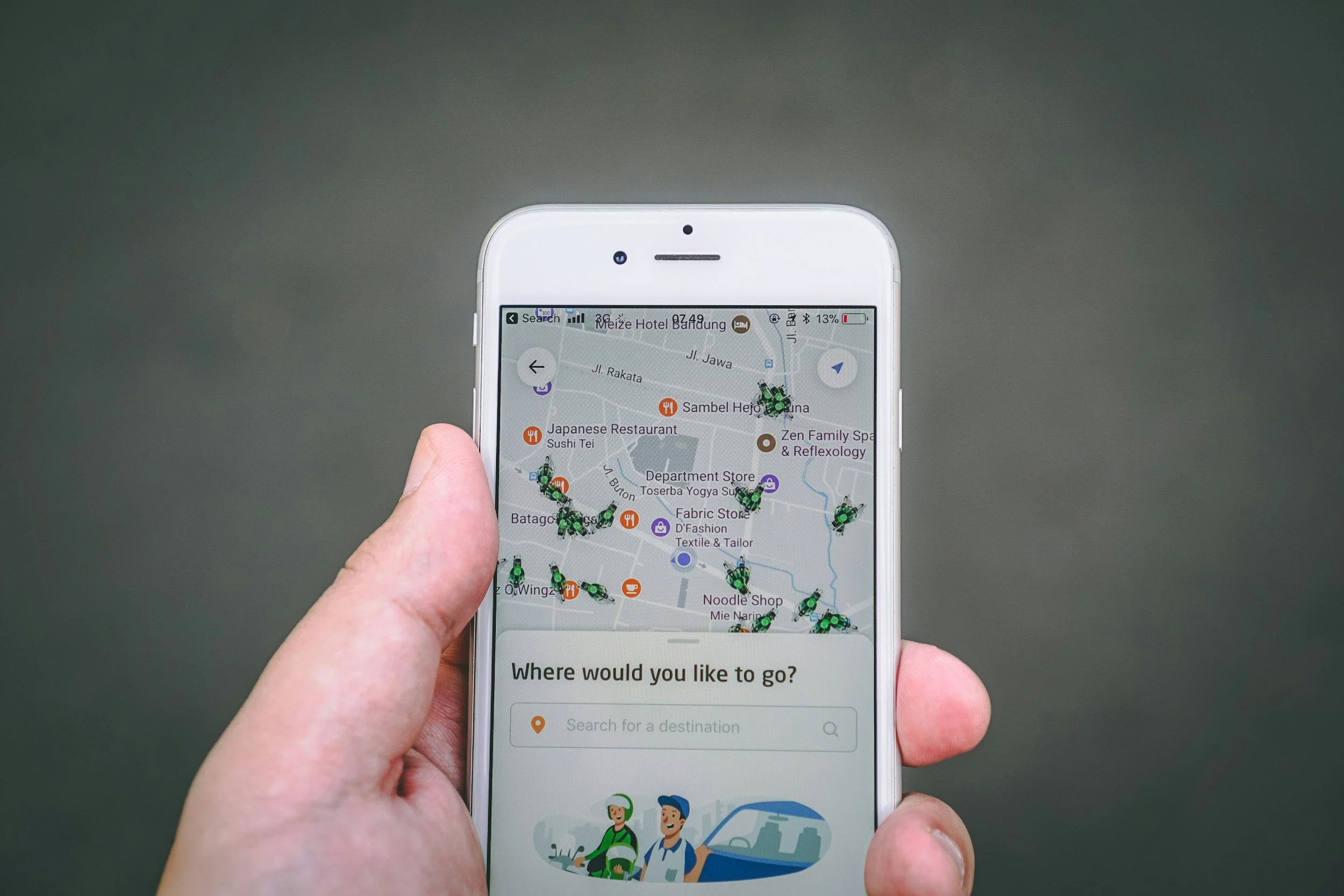

The platform economy includes economic activities facilitated by digital platforms, like websites or mobile applications. Commercial ridesharing and delivery services are two common activities in the platform economy sector. These activities are part of different areas of the platform economy, and come with different tax obligations.

The CRA would like to remind you that it has resumed debt recovery activities; here’s how it may impact your benefit, credit, and refund payments

The Canada Revenue Agency would like to remind you that it resumed its activities aimed at offsetting taxpayers' debt last October. Offsetting involves proactively applying tax refunds and benefit payments (such as the GST/HST credit) to tax and other government debts.

Are you a social media influencer? Here's what you need to know

Did you receive subscriptions and perks like merchandise and trips or other income?

If you earned income by posting pictures, videos and more on your social media channels that involves product placement or product promotion, you may be undertaking a business activity. You can earn income from your social media activities in many ways, both monetary and non-monetary (barter transactions), including, but not limited to…

How to: Collect, file and remit (pay) GST/HST

GST/HST is collected on most taxable supplies of property and services made in Canada, with some exceptions. The Canada Revenue Agency (CRA) has information to help GST/HST registrants file and remit the GST/HST that they have collected.

Register for a GST/HST account if you are an eligible entity and haven’t already registered

To find out if you should register for a GST/HST account, click When to register and start charging the GST/HST.

A GST/HST account number is part of a business number (BN) that is received after registering for a GST/HST account online, by mail or by fax, or by telephone.

Non residents who want to register for a GST/HST account can visit: Guide RC4027, Doing Business in Canada – GST/HST Information for Non-Residents.

Are you self-employed? The Canada Revenue Agency can help you understand your tax obligations

If you're self-employed, we understand that navigating your tax obligations may seem complicated. But don't worry! The Canada Revenue Agency (CRA) is focused on supporting you. To get ready for tax-filing season, we've put together helpful tips and information for self-employed individuals.

The 2021 tax-filing deadline for self-employed individuals is June 15, 2022. You have until June 15, 2022 to file your 2021 tax return if you or your spouse or common law-partner are self-employed.

The 2021 payment deadline is April 30, 2022. Although your 2021 tax-filing deadline is June 15, 2022, your payment is still due on April 30, 2022.

How to find help if you can’t pay your taxes

If you’re struggling to pay your tax debt, we understand and are here to help regardless of your tax situation. If you ignore your tax debt, it will grow with interest charges and penalties. Instead, let’s work together to figure out what your options are based on your financial situation.

Please note that penalties only apply if you file late or pay by instalments and your instalment payments are late or less than the required amount. Debts associated with COVID-19 Individual Emergency Benefits overpayments will not have penalties or interest assessed against the amount owing.