Making changes to your business? The Canada Revenue Agency is here to help!

The Canada Revenue Agency (CRA) understands that many businesses continue to change in response to new economic challenges and opportunities. As you undergo business changes, you may face different requirements in managing your tax affairs, and we are here to help, year-round, with your unique business needs.

Using an app or website to earn income? Here’s what you need to know about the Reporting Rules for Digital Platform Operators

You may be affected by Canada’s new Reporting Rules for Digital Platform Operators if you use digital platforms to earn income. These rules have been implemented to increase transparency and support compliance in the international tax community.

Under the rules, certain platform operators are now required to collect and report information on sellers considered to be reportable sellers to the Canada Revenue Agency (CRA). If you are a reportable seller, be aware of what is being reported by your platform operator(s) to ensure it’s accurate and consistent with what you report under existing tax obligations.

Operating a digital platform? Here’s what you need to know about the Reporting Rules for Digital Platform Operators

New reporting requirements for digital platforms have been implemented to increase transparency and support compliance in the international tax community. These reporting requirements are known as the Reporting Rules for Digital Platform Operators.

Under the rules, reporting platform operators are now required to collect and report information on sellers considered to be reportable sellers to the Canada Revenue Agency (CRA).

Teachers and parents: Join the movement to enhance tax literacy

Tax literacy is an important life skill, and we want to make sure that students have the knowledge, skills, and confidence to make the right decisions about taxes. This back-to-school season, we’ve got you covered! Whether you are an educator, a parent, or an organization that supports educational growth, there are many resources that you can take advantage of this academic year.

Students: It pays to do your taxes!

Heading back to school? Make sure tax literacy is on your course calendar! Understanding taxes will help you make smart decisions about your finances – how to put money in your pocket and help you save for a holiday, a car, or a house of your own.

Over half a million lower-income individuals will receive a SimpleFile invitation this summer

This July, the Canada Revenue Agency (CRA) expanded its SimpleFile services (phone, digital, and paper) to invite more than 500,000 eligible lower-income individuals to file their return and potentially gain access to important benefit and credit payments.

Clarifying the new GST/HST exemption for psychotherapy and counselling therapy services

As of June 20, 2024, certain psychotherapists and counselling therapists are no longer required to collect the GST/HST on their services. The Canada Revenue Agency wants to ensure that all providers of these types of services have the information they need to determine their tax situation and take any next steps, such as closing their GST/HST account.

Act quickly: File your 2023 corporate income tax return now to get the Canada Carbon Rebate for Small Businesses

The July 15 deadline approaches to be eligible for the Canada Carbon Rebate for Small Businesses. This refundable tax credit announced in Budget 2024 returns a portion of federal fuel charge proceeds directly to an estimated 600,000 small and medium businesses.

Get ready: By January 2025 there will be changes to the electronic filing of information returns

What is changing starting January 2025:

T619 electronic transmittal

Submitting one information return type per file

Early system shutdown notification, 2024

COVID-19 benefits – The Canada Revenue Agency is moving to the next phase of debt recovery

The Canada Revenue Agency (CRA) is responsible for collecting individual overpayments for all COVID-19 benefit programs, such as the Canada Emergency Response Benefit (CERB), the Canada Recovery Benefit (CRB) and the Canada Worker Lockdown Benefit (CWLB).

Starting in July 2024, for individuals who have not responded or co-operated, and who have been determined to have the financial capacity to pay, legal warnings will be issued and legal measures could be taken to recover monies owed. Legal measures are only taken when there is no cooperation from an individual with ability to repay the debt.

Beat the heat with CRA’s summer benefits

Whether you’re here for the heat or not – we know one thing will never go out of season: benefit and credit payments and tax-free savings.

Read on to find out what’s new, what’s changing, and what payments you could receive to help you beat the heat.

The Government of Canada announces new rebate to help businesses with carbon pollution pricing

The Canada Carbon Rebate for Small Businesses is a refundable tax credit announced in Budget 2024 to return a portion of federal fuel charge proceeds directly to eligible Canadian-controlled private corporations (CCPCs).

The Canada Revenue Agency (CRA) is working towards issuing the retroactive payments, which total over $2.5 billion with respect to the 2019-2020 to 2023-2024 fuel charge years.

You asked, we answered! Here are answers to six more of the top business tax information questions.

Earlier this month, we issued a tax tip answering your top seven business tax information questions. Now that the basics are covered, we can turn to more specific questions.

Reminder - Apply by June 30 for period two of the interim Canada Dental Benefit!

The deadline to apply for the second and last benefit period of the interim Canada Dental Benefit (CDB) is fast approaching – apply by June 30! Don’t miss out on your opportunity to get up to $650 per child for dental care. To be eligible, your child must have received dental care between July 1, 2023, and June 30, 2024.

The information below will help guide you through some of the important questions that you might have when it comes to eligibility, how to apply, and how you can get your payments quickly.

The deadline for self-employed individuals to file their 2023 income tax and benefit return is approaching

The Canada Revenue Agency (CRA) is here to support you and your business in meeting your tax obligations.

If you are a self-employed individual, or your spouse or common-law partner is self-employed, you have until June 15, 2024, to file your 2023 income tax and benefit return. Since June 15, 2024 falls on a Saturday, you will be considered to have filed on time if we receive your return on or before June 17, 2024.

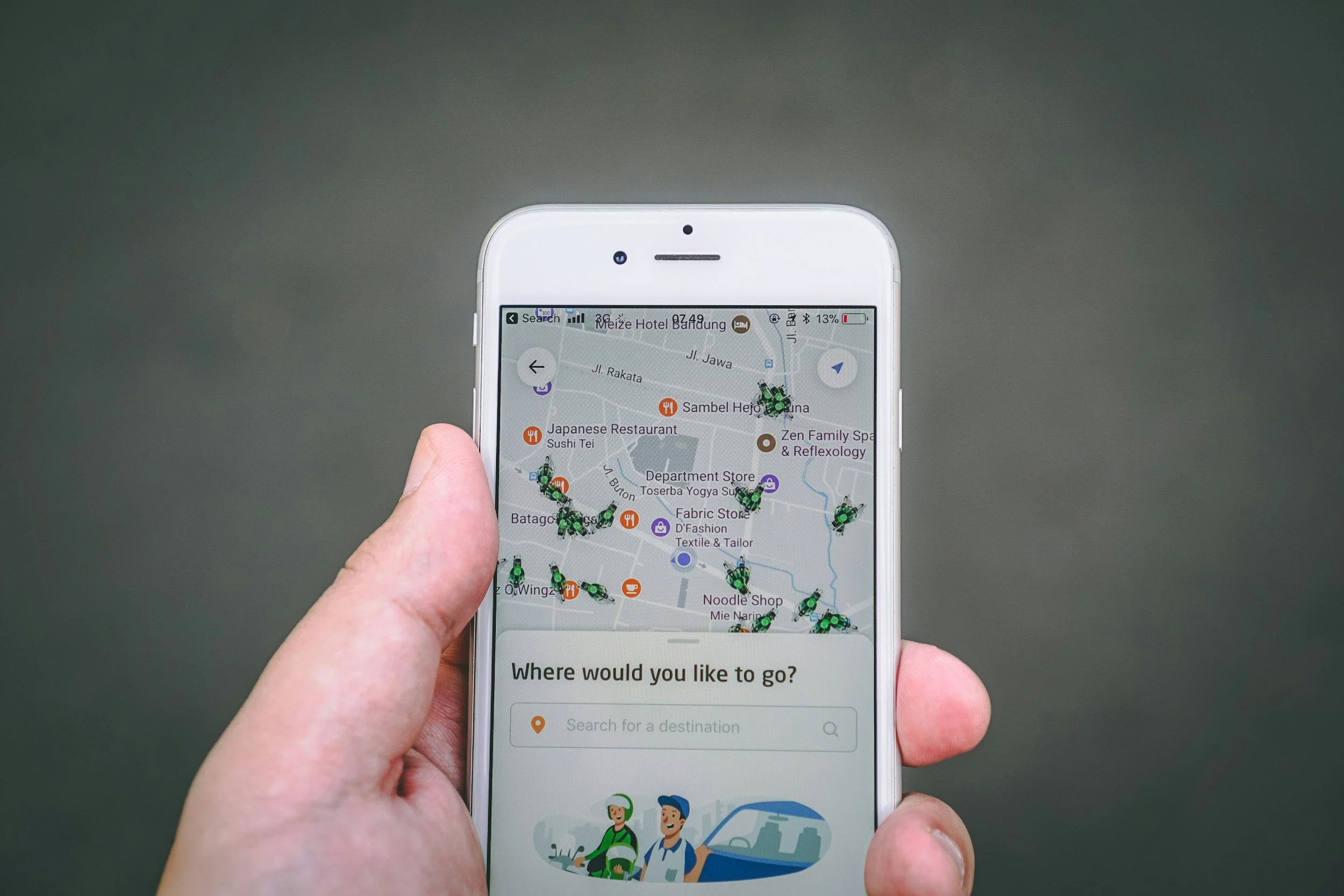

REVISED - Tax obligations for commercial ridesharing and delivery services

The platform economy includes economic activities facilitated by digital platforms, like websites or mobile applications. Commercial ridesharing and delivery services are two common activities in the platform economy sector. These activities are part of different areas of the platform economy, and come with different tax obligations.

You’ve got questions and we’ve got answers! Here are answers to seven of the top business tax information questions

Question 1: What are some of the 2024 tax changes that could affect my business?

Last year, there were many announcements for businesses that took effect as of January 1, 2024. These include:

Changes to mandatory electronic filing thresholds

Changes to electronic filing for GST/HST registrants

New reporting requirements for trusts

To help you understand these and other changes, we’ve pulled together a quick reference tax tip that covers what you need to know. Please check out the reference tax tip here: Here are the top changes this year that will affect business taxes in 2024.

Supporting affordable housing: apply now for the GST/HST rebate for purpose-built rentals

From students to families to seniors to newcomers, Canadians are finding it difficult to find the types of rental homes they need at prices they can afford. To help ensure more rental housing is available for Canadians, the Government of Canada is providing a 100% rebate on the Goods and Services Tax (GST), or the federal portion of the Harmonized Sales Tax (HST), on new purpose-built rental housing (PBRH). This housing includes apartment buildings, student housing and seniors’ residences. Applications for the PBRH rebate can be made online starting May 13, 2024.

Looking for the fastest and easiest way to view and manage your business taxes online? Use our digital services!

Our digital services make handling your business tax matters faster and easier. You and your authorized employees and representatives can file, pay and access detailed information about your tax accounts. Here is information about the Canada Revenue Agency’s (CRA) most used digital services, as well as information about how to access other services too.

Calling organizations that host free tax clinics – apply now for the CVITP grant!

The Canada Revenue Agency (CRA) is now accepting grant applications from community organizations that offer free tax clinics through the Community Volunteer Income Tax Program (CVITP) and the Income Tax Assistance – Volunteer Program (ITAVP) in Quebec. Eligible organizations can apply from May 1 until June 30, 2024.