TFSA vs. RRSP

What are the differences between a TFSA and RRSP?

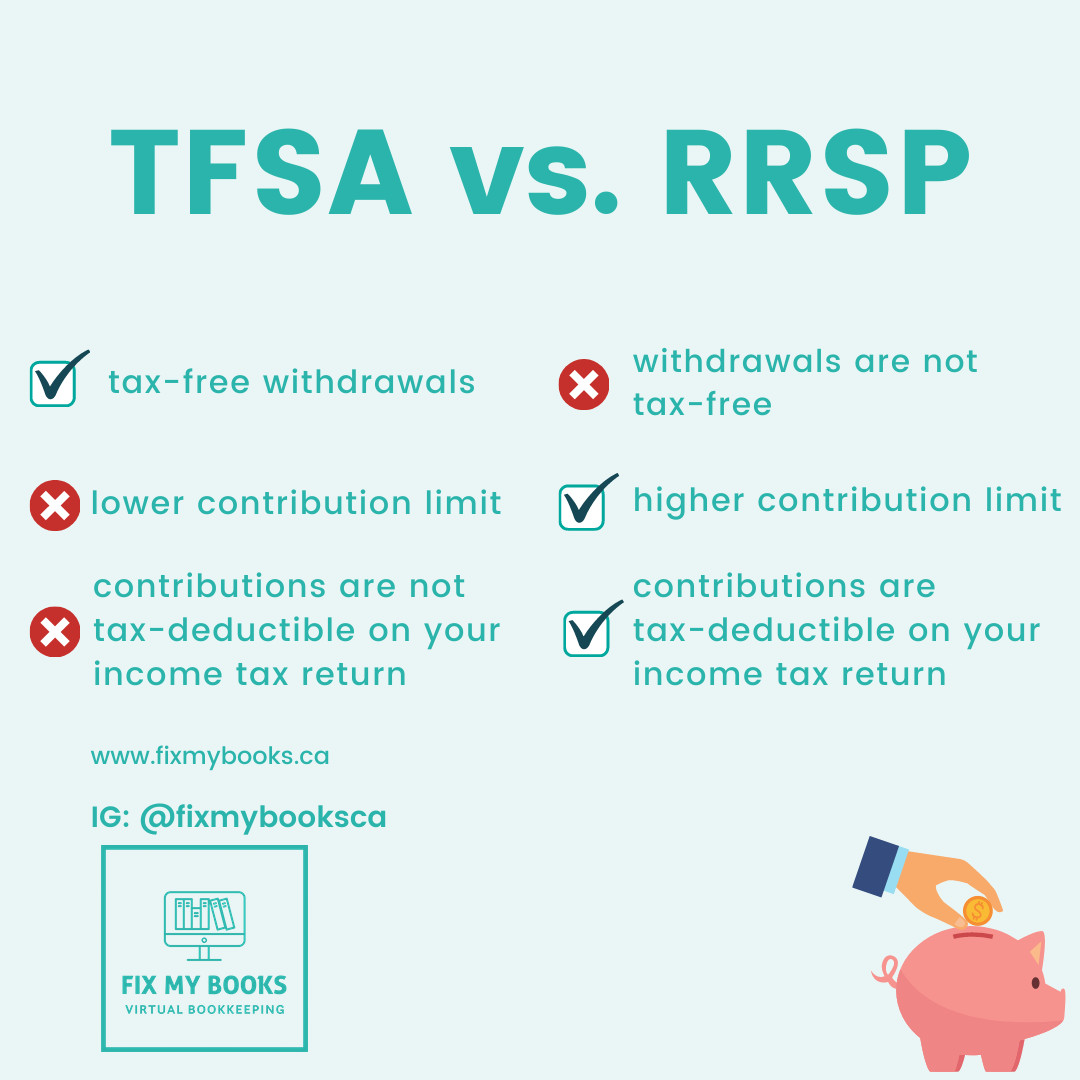

Here are some of the main differences between a TFSA and RRSP accounts below:

TFSA (After-tax money in, no tax on the way out)

It is a way for individuals (18+ with a valid SIN) to set money aside tax-free throughout their lifetime.

TFSA contributions are not deductible for income tax purposes because on withdrawal the capital gain is not taxed. This is why they have lower limits than RRSP’s.

Amounts contributed as well as any income earned in the account (for example, investment income and capital gains) is generally tax-free, even when it is withdrawn.

Administrative or other fees in relation to TFSA and any interest or money borrowed to contribute to a TFSA are not tax deductible.

RRSP (Pre-tax money in, tax on the way out)

An RRSP is a retirement savings plan that you establish, that the CRA registers, and to which you or your spouse or common-law partner contribute. Deductible RRSP contributions can be used to reduce your tax.

Any income you earn in the RRSP is usually exempt from tax as long as the funds remain in the plan; you generally have to pay tax when you receive payments from the plan.

To learn more about these different accounts, visit the CRA website (TFSA and RRSP) or schedule a free consultation with us.